Table of Content

Blog Summary:

Implementing fintech cybersecurity protects digital financial services from evolving cyber threats, data breaches, and online fraud. Businesses benefit from it by securing customer data, achieving compliance, and maintaining trust. This blog explores modern security challenges and strategic solutions, offering valuable insights for fintech founders, product leaders, and IT teams seeking sustainable, AI-powered security frameworks.

Table of Content

Fintech industry leaders rely on building customer trust through robust security systems. From online banking to e-wallet services, the bar for cybersecurity has dramatically risen. Suddenly, Fintech platforms have become the lifeline of modern consumers and powerful differentiators than they ever were.

Today, the fintech ecosystem handles everything from customers’ micro-investments to real-time credit card application approvals:

With AI-powered fraud detection, fintech cybersecurity has become a critical aspect of building a robust fintech app, making it non-negotiable. In fact, according to Gartner, Generative AI is expected to contribute to a 40% decrease in employee-driven cybersecurity by 2026, becoming the largest driver of improving organizations’ security posture.

This blog discusses the current shifts and challenges in cybersecurity to ensure that your fintech business’s cybersecurity strategy is free of gaps and flaws. It aims to guide you on your road to recovery from security breaches.

Fast, convenient, and interconnected systems require properly configured cloud buckets, secure mobile software development kits (SDKs), application programming interfaces (APIs), authentication, and timely continuous integration/continuous development (CI/CD) pipeline updates.

Here’s an overview of the most common fintech cybersecurity problems faced by financial tech organizations and the solutions they can build:

| Fintech Problem | Cybersecurity Solution |

|---|---|

| Stringent and Evolving Regulatory Compliance | Compliance Automation, Security Risk Assessments |

| Data Privacy and Customer Information Protection | Data Encryption (at rest & in transit), Tokenization |

| Cybersecurity Threats (Phishing, Malware, Ransomware) | SIEM (Security Information and Event Management), Threat Detection Systems |

| Third-Party and API Risks | API Security, Third-Party Risk Management |

| Fraud Detection and Prevention | AI/ML-Based Fraud Detection, Behavioral Analytics |

| Balancing Seamless UX with Strong Security | Identity and Access Management (IAM), Adaptive Authentication |

| Managing Infrastructure Complexity | Cloud Security Posture Management (CSPM), Zero Trust Architecture |

| Incident Response Readiness | Automated Incident Response, Playbook Development, Forensics |

However, speed can breed exposure to data breaches for the builders and protectors of such a fast-moving ecosystem. This is why fintech app security is a critical business pillar for:

With airtight security and stringent data protection practices, user retention increases, growth multiplies, and compliance fines take a backseat. Hence, businesses should aim to build confidence through every interaction with their customers.

Financial loss due to fintech cybersecurity threats and cybercrimes is the costliest loss for organizations, and it is projected to reach USD 24 trillion by 2027. Similarly, Cybersecurity Ventures predicts that the global annual loss due to software supply chain attacks will reach USD 138 billion by 2031, up from USD 60 billion in 2025.

Let’s understand the challenges it could create for product managers, founders, CTOs, CIOs, and even security architects:

Fintech platforms are API-driven, cloud-native, and mobile-first, featuring sleek interfaces that hide a web of complex systems and integrations underneath.

Hence, compliance heads need to navigate a maze of cross-border regulations, including the General Data Protection Regulation (GDPR), the California Consumer Privacy Act (CCPA), and the Payment Card Industry Data Security Standard (PCI-DSS).

To ensure consistent controls, fintech cybersecurity frameworks with automated audits and real-time policy enforcement are needed.

Protecting sensitive customer financial data is about earning customer trust, and the challenge is not to lose it by safely storing and transmitting it. These include social security numbers (SSNs), account information, and transaction histories, which need strong data encryption at both rest and transit.

For example, product managers need not worry about slowing down time to market; with role-based access and tokenization, they can handle any data leak or mishandling.

CTOs and CIOs for big fintech enterprises often rely on payment processors, credit bureaus, and vendors for know-your-customer (KYC) and anti-money laundering (AML). All these third parties can often increase external risks, even if there is one weak link in the chain.

With zero-trust network access (ZTNA) and vendor risk assessments, they can gain real-time visibility into third-party activities.

Startup founders often need security without spending enterprise-grade budgets on introducing user experience, authentication, and behavioral analytics. By speeding up user onboarding, they can access services with an intuitive user experience (UX) design.

They can also build frictionless fintech cybersecurity controls with invisible encryptions for passwordless logins and secured KYC checks, which are also faster.

Fraudulent transactions occur in milliseconds, and static rule sets of slow manual alerts can lead to false positives. For example, in February 2024, Bank of America experienced a data breach that exposed customers’ names, Social Security numbers, and account details.

It was a result of a cyberattack on Infosys McCamish Systems, a third-party subsidiary for data processing, and the weakest link.

Advanced persistent threats (APTs), credential stuffing, and phishing are the most common modern cybercrimes in fintech. Since attack surfaces are wide, automated attackers can fragment responses.

For example, Microsoft Azure security was compromised when cyberattackers leveraged phishing attacks to take over the accounts of senior executives in Microsoft Exchange Servers.

Build a security-first architecture for your fintech business that balances security protocols without losing loyal customers.

Statista predicts that by 2030, global information security spending will reach over USD 300 billion. Hence, fintech companies face the urgent challenge of turning security incidents into strategic opportunities.

Let’s understand some of the most prevalent fintech cybersecurity threats through real-world incidents:

Phishing has been the most prevalent threat. In this type of attack, attackers deceive users into revealing confidential information about customers. Pretending to be legitimate financial bodies, these attackers cause unauthorized access and financial fraud.

APIs can become exposed to vulnerable entry points and data breaches, compromising sensitive financial data. For instance, the MonoX Finance incident in 2021 resulted in a USD 31 million loss due to a smart contract vulnerability.

Insider fintech cybersecurity threats are usually risks from negligence by employees or malicious acts, which can pose significant risks. Having access to sensitive systems can inadvertently or deliberately cause data breaches, leading to substantial data compromises.

Ransomware and malware attacks involve hackers encrypting data by inserting malicious code or software into a system. They usually demand payment for releasing the software, disrupt operations, and erode customer trust.

For example, on 22nd April 2025, Marks & Spencer suffered a similar attack on its online orders, which disrupted its services.

Weak or outdated encryption protocols, though silent, are dangerous vulnerabilities that can lead to massive data breaches and compliance violations.

For instance, in 2020, the digital banking platform Dave suffered a similar fintech cybersecurity breach. Its weak encryption led to the data loss of over 7.5 million users.

The fintech industry requires a proactive approach in an environment where cybersecurity solutions are expected to protect sensitive financial data at every touchpoint.

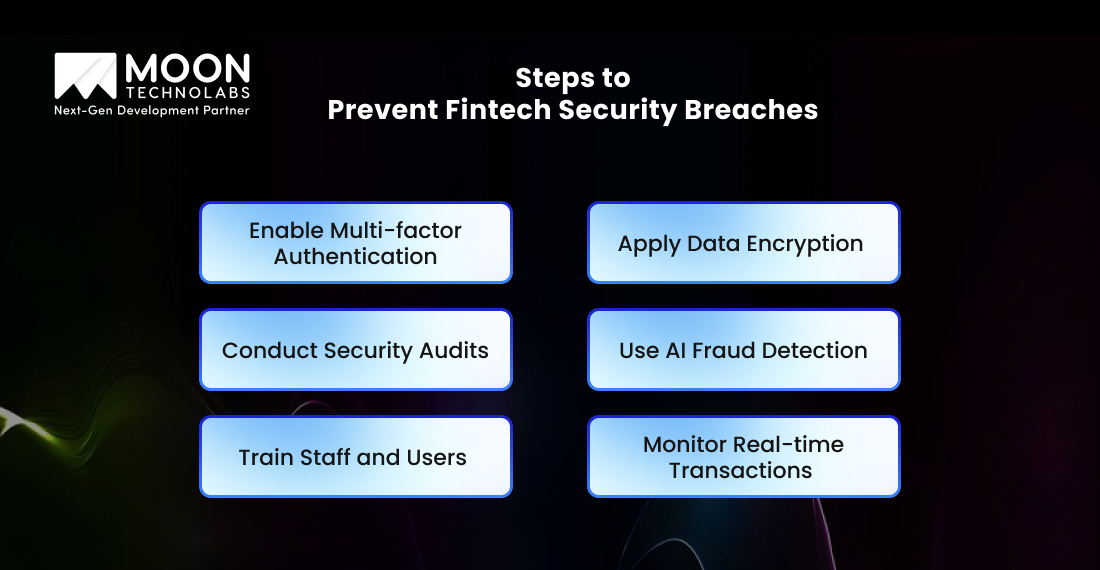

Here’s a step-by-step guide to prevent them:

Identify potential vulnerabilities and threats within the fintech platform to assess their impact. Then prioritize them based on potential consequences and enable MFA to strengthen access controls through passwords, biometrics, or tokens.

Encrypt customers’ sensitive financial data using robust encryption tools, whether the data is on the move or at rest. Utilize data-centric security solutions to implement encryption strategies tailored to your needs.

Conduct regular updates and software patches to keep all software up to date and protect operating systems and applications against exploits and vulnerabilities.

Utilize and implement AI-based fintech cybersecurity tools that enable you to detect fraud with advanced threat modeling and monitoring. Use ML algorithms to identify suspicious activities and provide real-time insights.

The second-last step is to provide regular education and training to the staff and employees on implementing best practices in fintech cybersecurity. This will help prevent social engineering attacks and internal negligence.

Securely integrate APIs and third-party services and prepare your organization for potential security incidents by developing comprehensive incident response plans.

Building modern cybersecurity solutions enables fintech businesses to be prepared for potential risks and better understand them. However, even with robust protections in place, breaches can occur.

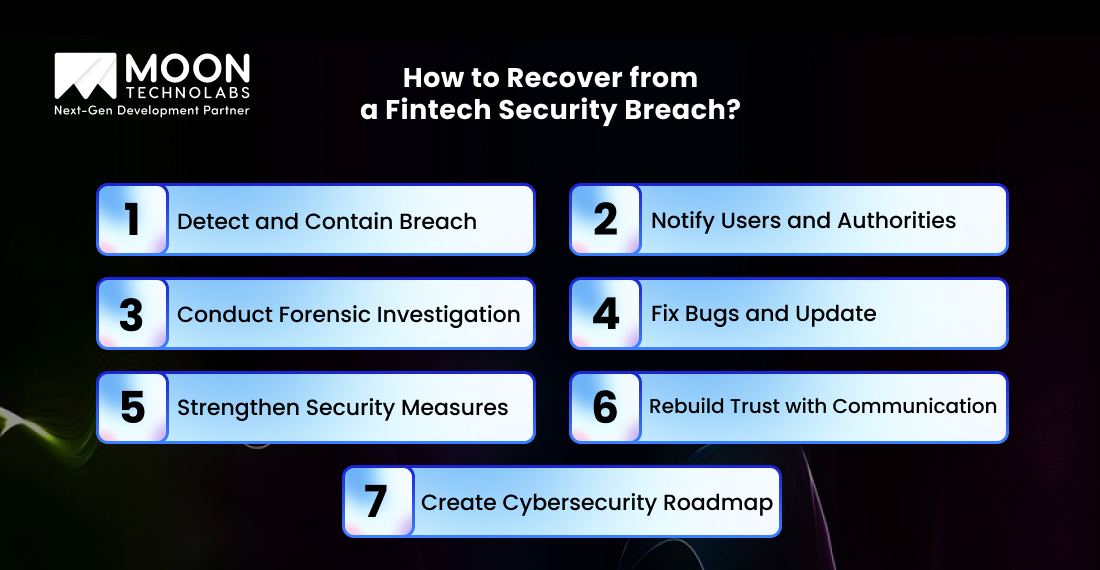

Here’s a succinct roadmap of security best practices and pieces of advice from our experts for fintech businesses to help them recover stronger from any security breach incidents:

Activate your incident response plan immediately to isolate affected systems and minimize the spread of the breach. Utilize AI threat detection to reduce detection and response times.

Recommended Tools:

Based on the compliance frameworks your fintech business uses (such as GDPR, PCI DSS, and GLBA), prepare clear templates to inform regulators and users about breaches promptly.

Recommended Tools:

Conduct a thorough forensic investigation to understand how and why an attack on your fintech system has occurred. Engage third-party forensic experts for unbiased assessments to identify the root cause and systems involved.

Recommended Tools:

Act decisively, patch all the vulnerabilities, and update security protocols. Based on the findings of forensic investigations, enhance access controls and adopt a “zero-trust” architecture.

Recommended Tools:

Use the data breach as a catalyst for transforming your fintech cybersecurity by reviewing and updating your policies and compliance frameworks. Shift toward proactive approaches, such as pen-testing and risk-based authentication.

Recommended Tools:

Keep your customers informed about recovery actions to ensure their data safety. Build communication with them around security reinforcement and being future-ready.

Recommended Tools:

Develop a comprehensive fintech cybersecurity roadmap with annual reviews, modernization goals, and compliance upgrades to create future priorities.

Recommended Tools:

Prepare for the unexpected with proactive plans, investigative roadmaps, and transparent communication strategies.

As fintech cybersecurity continues to evolve, this landscape will see numerous trends that are essential for stakeholders to understand. From AI shaping fraud detection with real-time data to building zero-trust models, the new trends are reshaping the way the Fintech industry defends itself against cyberattacks.

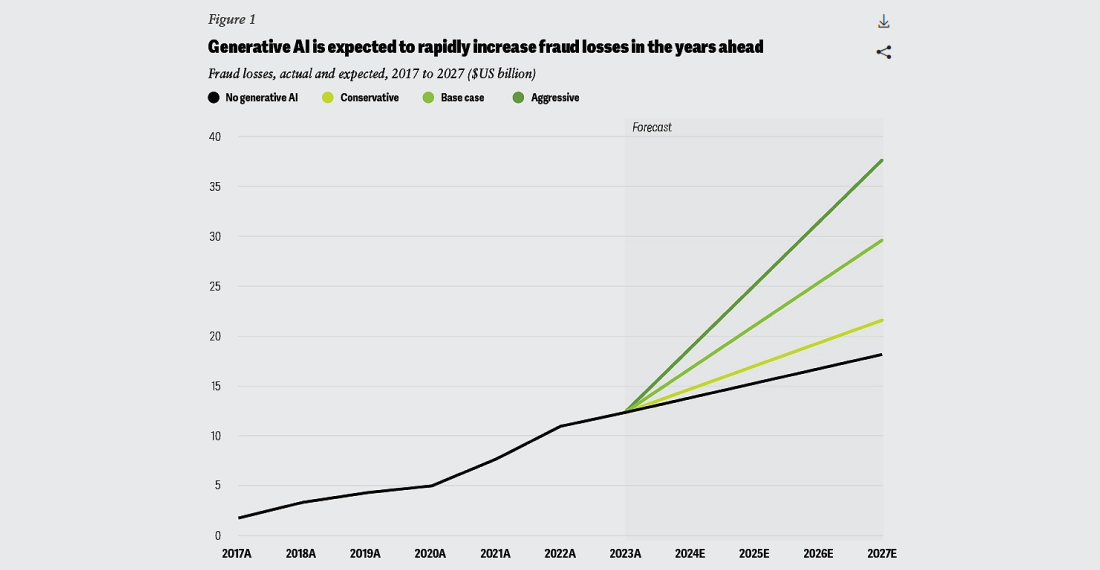

Generative AI could increase the banking fraud losses to USD 40 billion by 2027. However, AI and ML will join forces yet again to enhance fintech security with real-time threat detection intelligence. Both technologies will enable Fintech to adapt easily to new attack vectors.

The adoption of zero trust models will become a benchmark in fintech cybersecurity. This approach operates on the principle of “never trust, always verify,” ensuring that every access request is authenticated, authorized, and encrypted.

Blockchain technology will continue to prevent fraud by building a trust engine among fintech companies, creating a secure network of transparent transactions. Even after Decentralized Finance (DeFi) declined in 2023, it made a comeback in 2025 and is projected to grow at a rate of 46.8% from USD 30 billion in 2024 to USD 648.5 billion in 2032.

Fintech companies will invest more in biometric authentication, behavioral analytics, and adaptive security measures while maintaining seamless user interactions. These advancements aim to reduce friction in user journeys, which in turn improves customer satisfaction and retention.

Fintech cybersecurity isn’t just a strategy; it’s foresight and brand equity. An early investment in cybersecurity can help your business better prepare to prevent high-impact breach attempts and build a loyal customer base.

Whether you’re building instant lending apps, crypto wallets, neo banks, or robo-advisors, integrating cybersecurity into your solutions makes them resilient to cyberattacks, hackers, and other external threats.

Backed by deep domain knowledge and forward-thinking engineers, we are a leading fintech software development company. We deliver scalable solutions that grow with your product and protect every layer.

At Moon Technolabs, our expertise covers regulatory compliance automation, third-party risk management, secure API integrations, and user-first authentication systems. We ensure that in your fintech business, money moves to customers through the safest, most private routes and at scale, providing a competitive advantage.

Let’s talk about security, compliance, and innovation. Book a free consultation and discover how we can help future-proof your fintech platform.

In a world where one API vulnerability can compromise millions of user accounts, fintech companies face a pressing challenge: how can they scale innovation without compromising security?

They can only do this by ensuring that every line of code is written to delight the user experience, leave no door open for attackers, and protect them against vulnerabilities. This is where building custom fintech cybersecurity solutions becomes essential and strategic.

This blog unpacked the evolving risk landscape, key stakeholder challenges, and future trends, all while advocating for AI-driven, real-time, compliance-ready solutions.

01

02

03

04

Submitting the form below will ensure a prompt response from us.