Table of Content

Blog Summary:

This blog enables you to explore the importance of financial analytics software for an organization in decision-making and its complete growth. From basic information, we explain various vital details of this software, whether its use or benefits. We let you go through a list of the most sought-after financial analytics tools to select the best one for your business. Let’s explore all these without wasting any further time.

Table of Content

Managing financial data is a challenge that many businesses often face, particularly those relying on traditional methods. When you manage your financial data manually, it requires more time and also leads to numerous errors. So, what’s the solution to get rid of it? Using the financial analytics software is the right solution.

The most promising advantage of using this software is it automates the majority of day-to-day activities related to accounting. This allows you to save time by minimizing errors that occur when handling these tasks manually.

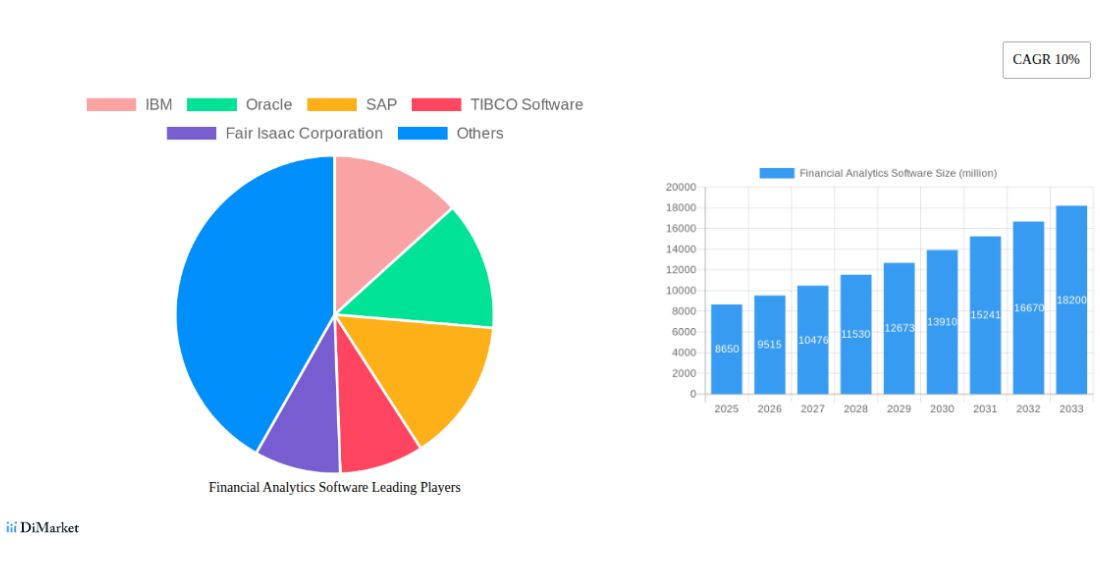

The benefits have increased demand for this software among businesses from diverse sectors, thereby also enhancing its market size. A report from Data Insights Market reveals that the financial analytics software market size is expected to be approximately $8.65 billion in 2025 and is likely to grow at a CAGR of 10% from 2025 to 2033.

Whether you are a small, mid-level, or established market player, investing in the right financial analytics software is indeed decisive. In this post, we will delve into the software in more detail and explain why businesses should consider utilizing it.

Financial analytics software serves as an online tool. It helps businesses to gather, analyze, and process financial data. It’s essential to make an informed decision. The software provides comprehensive insight into key financial metrics, including expenses, revenue, cash flows, profit margins, and forecasting, among other key indicators.

With real-time dashboards, data visualization, and predictive analytics, financial analytics software empowers organizations to perform various activities, including risk management, trend identification, budget optimization, and overall financial performance enhancement. Be it financial analysis, CFOs, or business leaders, this tool is used by everyone.

As mentioned, businesses leverage financial analytics software for various purposes, ranging from financial prediction to risk management. We have explained some of the use cases of this software below:

Financial analytics software can transform even complex financial data into meaningful insights by utilizing visualization tools. Users can easily identify patterns and trends in their financial data through charts, dashboards, heatmaps, and graphs.

These tools are useful for executives to identify key performance indicators (KPIs) and track revenue, profits, expenses, and other key metrics.

Besides, they can also compare the actual results with the projected results in detail. The financial analytics software provides clear and comprehensive visuals to help users make informed decisions quickly and with greater confidence.

Financial analytics software plays a crucial role in developing a long-term strategy with accurate predictions. It enables businesses to develop financial models that can accurately predict future performance based on current market trends, historical data, economic scenarios, and other relevant factors.

They can also set a clear goal by using various features of this software, including budgeting, cash flow forecasting, variance analysis, and more. It enables organizations to allocate resources effectively and plan proactively for various financial outcomes. This helps organizations to get a competitive edge.

Companies can leverage financial analytics software to identify potential risks, such as liquidity issues, credit defaults, and market volatility. Once businesses are aware of risks, they conduct a comprehensive assessment of the likelihood of these risks occurring and their overall impact.

It also allows businesses to take various preventive actions. Apart from this, the software also assists organizations with several other important tasks, such as generating accurate reports, conducting automotive audits, and tracking adherence. It helps them minimize any financial or legal exposure.

By utilizing financial analytics software, organizations can minimize the need for manual intervention, thereby reducing errors. It enhances operational efficiency, allowing finance teams to focus on activities that add value.

The software also works effectively for activities such as optimizing pricing strategies, cost-saving opportunities, and enhancing budget utilization. These all contribute in the most effective way to maximize profitability. It works well to increase productivity and, thus, profit.

When an organization makes an informed decision, it helps grow tremendously and also ensures its higher stability. A financial analytics tool provides investment analysis by calculating risk-return ratios, assessing the performance of various assets, identifying profitable opportunities, and more.

The software enables organizations to create a realistic picture of various investment scenarios and thus determine potential outcomes. It’s necessary to ensure that every investment aligns with business objectives.

Get data-driven insights to empower your business. We encourage you to build custom financial analytics software tailored to meet your specific requirements.

Consult Us to Hire

Many data management software solutions have gained vast popularity and acceptance among businesses for being highly efficient and featuring cutting-edge capabilities. We will discuss some of the top softwares that organizations leverage most frequently:

Oracle Essbase is a robust multidimensional database management system that analyzes data in an online analytics process. The software is a suitable option for companies that perform scenario analysis, forecasting, complex financial modeling, and other tasks.

Large enterprises find this software more suitable for their needs, such as financial planning and advanced data analytics. It can be integrated smoothly with the EPM suite and Oracle Cloud and can handle even larger volumes of data with higher efficiency.

Features:

QuickBooks, one of the most used accounting and financial data management software, is a perfect tool for a large number of small and mid-sized businesses. The software is capable of tracking expenses, managing invoices, generating reports, and reconciling bank accounts conveniently.

Whether it’s an intuitive interface, cloud-based accessibility, or scalability, the software includes everything to become a top choice among businesses.

Features:

You Might Also Like:

Owned by Oracle, NetSuite is another popular data analytics and management software. It’s a cloud-based ERP platform that provides complete business management, including inventory, CRM, financials, and HR.

NetSuite is an appropriate financial analytics software for both mid-size and enterprise-level businesses. Whether it’s robust global compliance support, customization, higher scalability, or real-time visibility across multiple departments, the software has gained widespread popularity among businesses for various reasons.

Features:

ThoughtSpot is another tool designed mainly for users who are technically novices. It redefines the way businesses access data with the help of its natural language search engine. It doesn’t rely on data analysis, whether it’s enabling real-time answers to even complex queries.

ThoughtSpot makes data accessible across multiple departments with complete AI-based insights. The tool can integrate with numerous leading cloud data platforms, including Redshift, Snowflake, Google BigQuery, and others.

Features:

Being another cloud-based financial analytic software, Sage Intacct is tailored specifically for fast-growing financial departments and businesses. The tool is capable of automating major accounting activities and provides complete, insightful financial reporting.

With real-time visibility into key financial metrics, the tool enables cash management, core accounting, and multi-entity consolidations.

Businesses can utilize this tool to gain real-time visibility into key details, including audit trails, project accounting, and revenue recognition. Whether it’s powerful automation features or flexible reporting capabilities, Sage Intacct emerges as a top choice for financial departments and CFOs.

Features:

Although it’s new, Refrens is a robust financial software that helps you perform tasks such as invoicing and expense tracking. It primarily focuses on small service providers and freelancers. The tool offers a user-friendly and lightweight platform for managing client data, invoices, financial records, and other essential information.

Refrens has the capability of combining simplicity with necessary data tracking ability. Whether it’s lead management, payment tracking, or generating basic reports, it brings possibilities for everything.

Features:

As a flexible enterprise performance management tool, Jedox offers immense potential to combine budgeting, planning, and forecasting through robust analytics. It encourages companies to simplify their financial planning and operational prediction processes using self-service tools.

It features an Excel-like interface that combines AI-driven forecasting and multidimensional modeling. It’s highly accessible for financial professionals while offering more powerful enterprise features.

Features:

Being an important part of Salesforce, Tableau is a robust tool for business intelligence and data visualization. It has the capability of turning raw data into interactive and meaningful dashboards and reports.

It features a drag-and-drop interface that supports robust visual analytics, eliminating the need for coding, and making it a top choice among both businesses and analysts. The tool has the capability of connecting to a range of data sources and also offers complete support for real-time collaboration.

Features:

Domo has the potential to connect data across multiple systems and ensures its accessibility with the help of customer dashboards. It provides a full-stack business intelligence platform that integrates multiple components, including data pipelines, collaboration tools, and visualization, into a comprehensive cloud environment.

It’s a perfect tool for enterprises that aim to foster a data-driven culture across multiple departments. The tool provides decision-makers with complete access to utilize important metrics, regardless of time and location.

Features:

You Might Also Like:

Cube is an advanced financial tool that integrates easily with Google Sheets, Excel, and other applications. It facilitates financial teams to plan, analyze, and report quickly. The tool is perfect for a team that relies heavily on spreadsheets.

Whether it is collaboration features, version control, or automation, it offers everything to make financial planning convenient and hassle-free. The tool can be integrated with CRM systems, ERP systems, data warehouses, and other relevant systems.

It enables finance teams to create complex models. It minimizes the overall gap between enterprise-grade planning solutions and traditional spreadsheets.

Features:

Leveraging robust financial software enables an organization to reap numerous benefits. We will discuss some of the most promising advantages one by one:

When it comes to data accuracy, it’s one of the vital factors for effective decision-making. When you handle data manually, it can lead to errors such as missing values, duplicate records, inconsistent formatting, and other issues. These issues indeed compromise the integrity of the data.

Data management software encompasses a range of functionalities, including automated cleansing tools, validation rules, standardization features, and other advanced capabilities. It ensures the storage of information with a higher accuracy.

It minimizes the overall chances of making business decisions according to outdated or faulty data. An improved data quality also causes effective customer service, marketing, and operational planning.

A cutting-edge data management platform boasts numerous features that emphasize teamwork and also cross-departmental collaboration. Cloud-based data systems enable users to access and edit data in real time, ensuring everyone is aligned perfectly.

By using role-based access controls, team members can easily view only the details relevant to their work. It indeed streamlines workflows and also maintains great privacy. The tool fosters data sharing while enabling companies to improve communication collaboration environments and minimize duplication of work.

Organizations often take numerous strategies to secure their financial and sensitive data. They can also use data management software for this purpose.

The tool is available with top security features to ensure the safety of data from leaks, unauthorized access, or any breaches. These features include encryption, user authentication, audit trails, and access control, among others.

Apart from this, cloud-based solutions also offer disaster recovery options and automatic backups, which reduce the overall risk of data loss mainly due to cyberattacks or system failures. A powerful data management system enables businesses to comply with various legal obligations and avoid penalties.

Every business grows over time and produces more data. They often face difficulty when it comes to managing the vast amount of data, especially with limited capability. Data management solutions enable them to do it with a higher efficiency and thus scale easily.

Whether a business expands its operations across multiple regions, adds new users, or integrates with other systems, a powerful data platform adapts smoothly to maximize complexity and volume, even without sacrificing its performance.

Whether it’s data retrieval, entry, or reporting, automating these tasks is beneficial in saving time. It minimizes the necessity for manual or repetitive tasks. It enables employees to focus more on strategic activities that are directly related to the business’s growth and development.

Financial analysis tools come with cutting-edge functionalities, including pre-built dashboards, advanced search capabilities, and seamless integration with numerous other business tools. These improve their day-to-day operations. As a result, it enhances workflow efficiency while minimizing operational costs.

Making an informed decision is possible only with proper data management. Leaders can utilize timely, accurate, and well-organized data to extract valuable insights from various analytics and reporting tools available with most financial analytics software.

Businesses can utilize these important insights to identify major trends, predict challenges, assess their performance, and capitalize on numerous new opportunities.

They can make even complex information easy to understand by using visualizations and real-time dashboards. It enables both executives and managers to make data-driven and informed decisions that lead to the prosperity of their business.

Optimize decision-making by using data-driven insights. Redefine your financial operations with custom analytics solutions designed to drive significant ROI.

Talk to Us Now!

Moon Technolabs provides custom software development services for financial analytics, catering to accounting firms and financial institutions. We are a team of skilled developers who create custom-built analytics solutions tailored to meet the specific needs and objectives of your organization.

With extensive expertise in this field, we deliver innovative financial analysis software integrated with emerging technologies, including machine learning and AI.

We provide secure and scalable solutions that serve you in multiple ways, like customer behavior analysis, performance monitoring, regular compliance reporting, and more. We work with an agile approach to ensure faster deployment, cost-effective development, and seamless integration, resulting in quicker deployment and improved outcomes.

Financial analytics software has become a must-have tool for financial institutions and businesses across many other sectors. We already mentioned above the way this software serves businesses – data-based decision-making is one of those.

With the availability of a variety of tools, you can choose the right one based on your core business requirements. However, to obtain tailored solutions specifically designed for your business, please don’t hesitate to contact us. As a leading Financial Software Development company, we deliver solutions that help you gain a competitive edge and achieve long-term growth.

01

02

03

04

05

Submitting the form below will ensure a prompt response from us.