Table of Content

Blog Summary:

This blog explores how investment banks can strategically apply AI and data science in investment banking to drive measurable ROI and efficiency. It highlights real-world use cases, role-specific benefits, and future advancements, with a focus on building scalable, insight-driven platforms. Learn how mapping services to client goals helps financial institutions turn analytics into actionable, revenue-generating outcomes.

Table of Content

The real power of data science in modern financial institutions lies in its strategic adoption. Each model and platform must directly contribute to the revenue growth and operational efficiency of investment banks.

Hence, investment banks and financial institutions are increasingly focused on understanding how they can maximize their return on investment (ROI). The integration of advanced analytics, AI, and domain-specific Data Science in Investment Banking is one of the compelling ways to help achieve these business outcomes.

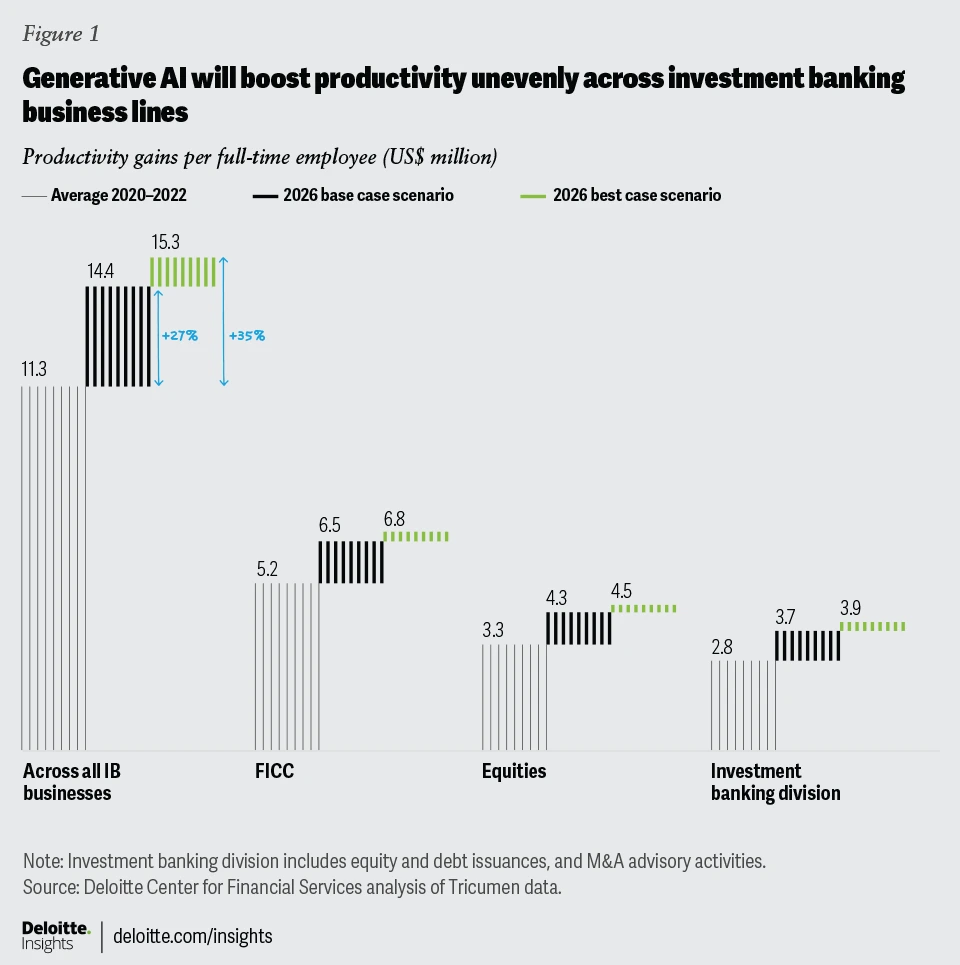

As Deloitte reports, AI with data analytics could boost the front-office productivity of investment banks by 27% to 35%. The same report also highlights that Generative AI is estimated to add approximately USD 3.5 million in revenue per banker by 2026.

To realize such business impact, they need to apply practical knowledge rather than theory-based approaches to influence better decisions with actionable insights.

In this blog, we’ll explore in-depth how mapping data science services to specific client goals can elevate building smarter and effective models that enhance their capabilities.

Applying data science in investment banking facilitates the development of several solutions. These range from predictive modeling in capital markets and custom AI dashboards for credit-risk analytics to automated reporting, fraud prevention, and optimizing client portfolios.

Even though such finance data science consulting for banks and other fintech firms can prove extremely useful, the crux lies in the consideration stage, where they need to compare thousands of vendors. Hence, this need is based on emphasizing differentiators such as data security, domain expertise, and scalability.

So, what turns data science from a buzzword into a real competitive advantage?

In investment banking, finance data science has been proven to improve the bottom line and accelerate growth directly. To bring these tools into practice, investment bankers and institutions often partner with analytic experts to help them build models and tools to support key processes.

We’ll understand more about this in the later sections.

Finance data science in today’s investment banking is more about achieving a balance between costs and benefits. An IBM study analyzed predictive analytics models, indicating an average ROI of 250% with over 2.5 times payback.

Developing even the most basic analytics fintech MVP system by applying data science in investment banking typically starts at USD 20,000 and can take anywhere from 3 to 6 months.

While adding AI features of NLP data parsing will add at least 15% to 20% more costs, it will create better long-term ROI and future payoffs for institutional investors.

Here are some platforms they can build to drive maximum value:

Let’s understand the impact of ROI-driven finance data science through a quick narrative comparison of building different types of data analytics in investment banking solutions for banking institutions:

| Platform Type | Est. Build Costs and Time | Return on Investments (ROI) | Key Benefits |

|---|---|---|---|

| Predictive Models | 3 to 6 months, Approx. USD 20,000 to USD 2,00,000 |

250% YoY ROI with 3 to 5 times revenue growth |

|

| Custom Dashboards and BI Reporting | 1 to 2 months, Approx. USD 30,000 to USD 1,50,000 |

100% ROI, payback within 6 to 12 months |

|

| Credit/Risk Engines | 6 to 12 months, USD 50,000 to USD 5,00,000 |

150% |

|

| AI Assistants and Bots | A few weeks to months, Approx. USD 40,000 to USD 2,00,000 | 150% to 300% |

|

For the investment banking business owners and the key decision-makers looking to upgrade their development tech stack, tools, teams of data scientists and engineers, data science in investment banking offers immense benefits for developing data pipelines.

Let’s have a look at some of the primary areas:

Synthetic data generation is crucial for model training, as there are numerous restrictions on using financial data. Investment bankers can utilize GANs and diffusion models to simulate realistic behaviors, how transactions take place, client profiles and fraud scenarios without exposure to real data.

According to McKinsey’s report, Gen-AI can help in improving productivity in investment banking by 30%. It can also help increase operating profits by 9%-15% by utilizing AI for algorithmic trading and portfolio management.

ML models can scan data and news feeds for the market, analyzing them to identify the most lucrative M&A opportunities and underpriced securities. Predictive data analytics in investment banking can help in ranking deals based on the expected returns and prioritizing banking efforts.

Using quantitative models with alternative data helps investment bankers forecast how price movements and asset mixes will affect the optimization. Furthermore, trading strategies can also be built on ML-powered algorithms that ultimately improve hit rates and returns after risk adjustments.

The global market of this industry is highly complex, with the introduction of new regulations, traditional ways have become obsolete and can’t produce the same efficiency. From predictive modeling to intelligent dashboards, data science has become a critically strategic imperative.

Investment bankers utilize finance data science to segment their client base based on behavior and provide personalized advice. It also helps them tailor their pitches accordingly and increase cross-selling opportunities. For the most relevant investment ideas, AI tools can triage research flows and emails.

We help investment banks build personalized customer data analytics platforms that drive real-time insights.

Leading firms are utilizing AI tools to identify market trends, execute complex deals, and automate routine tasks through data science, thereby reducing costs, protecting their margins, and driving growth.

Let’s understand some of the core applications of data science in investment banking, focusing on the solutions the financial institutions seek from development partners. We’ll also explain the ideal tech stack and app architecture for creating value-driven strategies:

Portfolio analytics platforms help investment banks utilize these for forecasting market trends and automating complex investment strategies.

Where Can Banks Apply It?

With Moon Technolabs, you can build portfolio management solutions that provide real-time insights for data-backed decisions.

Recommended Tech Stack for App Architecture:

With Big Data, banks can apply predictive analytics models in conjunction with machine learning algorithms to analyze volumes of market and customer data.

Where Can Banks Apply It?

With Moon Technolabs, you can build data analytics platforms that ingest and process huge datasets to produce timely forecasts and algorithmic trading signals.

Recommended Tech Stack for App Architecture:

In investment banking, cloud computing facilitates the migration of core systems to the cloud, as these platforms support elastic computing. It allows banks to run big-data workloads and AI models with proper cost control.

Where Can Banks Apply It?

With Moon Technolabs, they can build automated and secure cloud deployments with advanced analytics and compliance.

Recommended Tech Stack for App Architecture:

Modern banking utilizes predictive analytics for credit scoring, detecting fraud, and predicting customer churn rates. With finance data science, algorithmic trading helps execute trades faster in real-time.

Where Can Banks Apply It?

With Moon Technolabs, they can embed AI-enabled solutions into their existing systems and create predictive models.

Recommended Tech Stack for App Architecture:

Data analysis enables firms to extract valuable insights through clear visualization of financial datasets by identifying trends and optimizing strategies for trading and asset management.

Where Can Banks Apply It?

With Moon Technolabs, they can develop a tailored data analytics and function platform to analyze financial data and offer insights to drive better decision-making.

Recommended Tech Stack for App Architecture:

Data science enables investment banks to manage risks and meet compliance requirements by utilizing advanced quantitative models. They can now estimate key risk metrics of investment strategies such as the probability of default and value at risk.

Where Can Banks Apply It?

With Moon Technolabs, they can build custom intelligent platforms to automate data ingestion and run real-time analytics with integrated workflows.

Recommended Tech Stack for App Architecture:

Let’s examine some real-life use cases and examples of implementing data analytics in investment strategies, focusing on the benefits it can offer to CTOs, product owners, data science teams, and business analysts:

| Use Cases | What it Does | Real-life Example | Role-specific Benefits |

|---|---|---|---|

| Customer Segmentation | ML-based clustering identifies high-value and high-risk clients more effectively. | Goldman Sachs segments clients based on behavioral and transactional clustering to offer tailored banking services. | CXOs gain clearer visibility into client profiles for revenue forecasting and regional targeting. |

| Recommendation Engines | Real-time personalization drives engagement. | JP Morgan uses AI to recommend mutual funds or portfolios based on investor sentiment and past patterns. | Product owners deliver relevant investment product suggestions, increasing cross-selling opportunities. |

| Managing Customer Data | NLP streamlines compliance, reduces duplication, and saves analyst time. | Citi leverages automated pipelines for centralized client data ingestion and entity resolution. | Data Science Teams can automate and clean large datasets for accuracy. |

| Customer Support | NLP models automate Tier-1 support while ensuring faster response times. | Morgan Stanley’s AI chatbot handles trade queries, FAQs, and KYC reminders. | CXOs benefit from cost savings as AI reduces their dependency on human support without sacrificing service quality. |

| Customized Marketing | Improved targeting leads to better conversion rates and customer retention. | UBS uses predictive scoring models for campaign targeting based on investor goals and life events. | Business Analysts can align messaging with investment goals, boosting campaign ROI. |

| Lifetime Value Prediction | Predictive analytics prioritizes high-LTV customers for upsell and retention efforts. | Barclays applies LTV models to optimize portfolio allocation across customer life cycles. | CXOs get a predictive view of future client revenue, improving budgeting and relationship strategies. |

| Portfolio Construction and Optimization | Reinforcement learning helps adapt portfolios based on changing market conditions. | BlackRock’s Aladdin platform uses ML to optimize multi-asset portfolios in real-time. | Tech Teams integrate models to dynamically adjust risk exposure and returns. |

As the investment banking industry enters a new phase of enhanced decision-making, several capital markets operations have been replaced by natural language processing (NLP) and artificial intelligence (AI).

By helping banks generate regular reports, pitch books, and decks, as well as performance summaries, this space will enable analysts to spend more time on value-added analysis, reduce operational costs, and speed up decision-making cycles.

Let’s understand how the key value drivers will shape the convergence of AI/ML, a composable data infrastructure, and real-time data analytics in investment banking:

Technologies such as Apache Kafka, Spark Streaming, and Apache Flink will enable event-driven architectures that respond to market data and client interactions in real-time. Institutions will have faster response times with real-time data pipelines.

Platforms They Can Build to Drive Value:

GenAI will help build transformer-based models that will enable investment bankers to provide hyper-personalized advisory services. AI advisors will soon interact with clients through contextual responses tailored to their personal goals, history, and market conditions.

Platforms They Can Build to Drive Value:

Quantum computing is an emerging technology in data science for investment banking, offering computational advantages. It can help bankers solve high-dimensional investment problems, including portfolio construction and derivative pricing.

Platforms They Can Build to Drive Value:

AI tools like SHAP and LIME, along with model interpretation frameworks, will bring intelligence and transparency to help regulate better demand visibility into decisions.

Platforms They Can Build to Drive Value:

Don’t make your existing systems struggle with inconsistent forecasts and asset planning that delay crucial decisions.

Modern investment banks need to deploy data science across several roles. However, the implementation of data science in banking and financial systems needs guidance from fintech software development experts.

Hence, they often need to hire external teams to build solutions that are specific to their operations:

At Moon Technolabs, our expertise in building secure fintech platforms by integrating data analytics with AI-ML development services, such as Gen AI Integration, ensures that we translate your business requirements into:

Contact our expert developers to build secure fintech platforms.

01

02

03

04

Submitting the form below will ensure a prompt response from us.