Table of Content

Blog Summary:

Looking to build a Venmo-like app and the related costs? You have landed at the right place. We discuss factors that directly impact the development cost, along with other details like the benefits of developing any similar apps, features to integrate, development steps, and more.

Table of Content

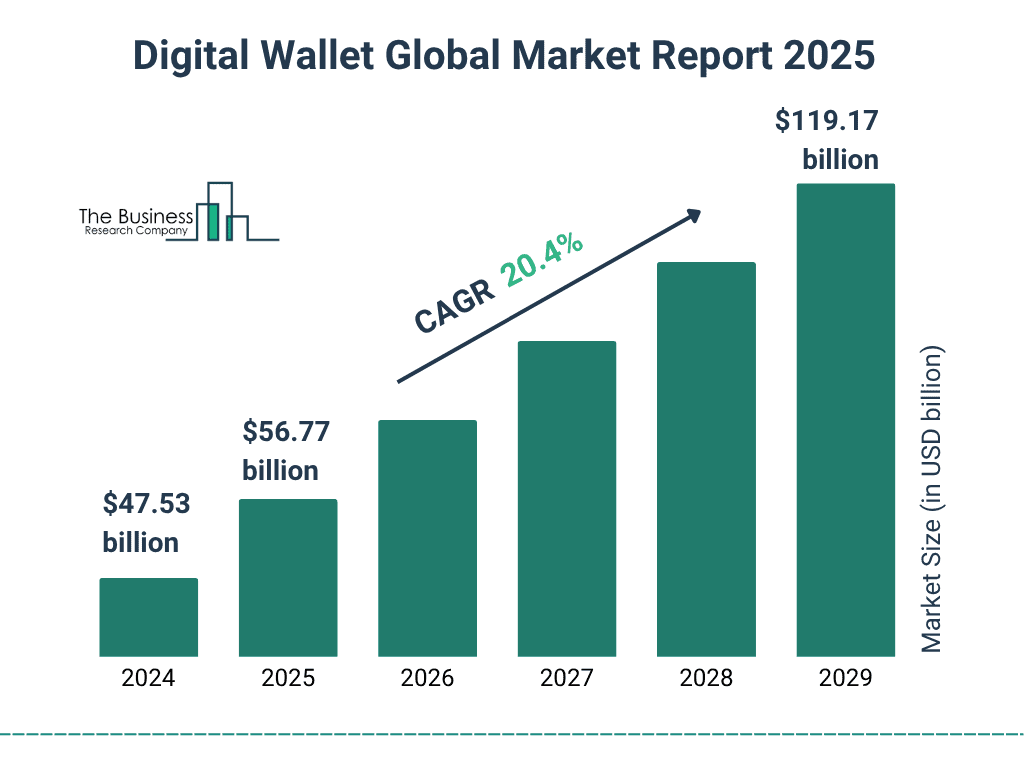

The digital payment revolution has transformed the way we spend and manage money. And many popular online payment apps have fostered this revolution—Venmo is one of them. With 92 million active users (according to PayPal) and having processed $300 billion in online transactions as of 2025 (according to CoinLaw), the app is successful in its own right.

An app similar to Venmo opens up multiple revenue streams for businesses that develop it. And thus it lures those looking for an innovative app development idea. If you are one of those, you need to know the actual cost to build an app like Venmo first. It helps you make your budget accordingly and thus proceed in the right way.

The cost of creating an app similar to Venmo depends on numerous factors like platform selection, tech stack, development hours, and more. In this blog, we will discuss more about the cost of developing a similar app.

Building an app like Venmo offers many advantages, from diverse revenue streams to improved user engagement and retention. Here are some of the key benefits:

A digital payment application like Venmo offers quick peer-to-peer transactions for everyday needs. These include paying rent, splitting bills, and reimbursing friends. Users can transfer funds in just a few taps. This convenience increases user satisfaction and maximizes app usage.

When it comes to security and speed, these are critical to making any digital payment app successful. The app, similar to Venmo, secures user transactions with its robust features such as multi-factor authentication, advanced encryption, fraud detection systems, and more.

It prevents users from any stress of data breaches while letting them do money transfers and store payment details smoothly.

The credit goes to Venmo’s social feed feature—it has redefined how users interact with payments. The app is considered much more than just a utility, with features like emojis, notes, payment comments, and more.

It allows users to like, view, and comment on transactions, etc. These make payment more fun and engaging.

Another advantage of developing a Venmo-like app is that it can generate multiple revenue streams. Be it instant transfer charges, premium subscriptions, transaction fees, or business partnerships, the app lets you earn revenue through multiple ways.

Besides, it includes additional features such as merchant payment solutions and cashback programs to boost monetization further.

An app-like Venmo improves user engagement and loyalty by combining speed, convenience, social connectivity, and more. Whether it’s personalized notifications, regular interactions, or reward programs, these apps include many features to keep users active.

Apart from this, when you integrate AI-based analytics into this type of app, it helps you understand actual user behavior. It’s essential to provide a tailored experience.

You need to understand that the cost of building an application like Venmo is not constant. It depends on many important factors such as platform choice, features, region, and more. App development rates vary worldwide.

Let’s explore more details about the cost to develop any such app:

Well, the average cost to develop an application like Venmo ranges from $60,000 to $250,000+. When you develop a basic app like an MVP with necessary features like transfers, user registration, security, and more, it requires less investment.

On the other hand, an app with advanced features such as social feeds, in-app chat, bank integrations, fraud detection, business payments, and more requires a significant investment.

As we already mentioned, developing an app similar to Venmo depends on many factors, including platform choice. When you select iOS or Android to develop your app on any of the platforms, it’s indeed less expensive. But it has a limited reach.

On the other hand, building apps natively on both platforms maximizes costs, mainly due to separate codebases. Meanwhile, cross-platform frameworks can minimize overall development costs while delivering outstanding performance.

The development team’s location is another important factor that has a higher impact on the overall cost. Let’s explore important details:

We help you transform your innovative financial idea into a fully-fledged fintech app. Our developers make it scalable, secure, and user-friendly.

When determining the cost to develop an app like Venmo, it’s essential to consider several key factors. We will discuss each important factor in detail:

App complexity is one of the biggest factors driving costs. As we mentioned above, a basic app with limited features can be built within a budget. Meanwhile, building a complex app with advanced features requires more development time and cost.

Design is a crucial factor in brand appeal and user retention. An app similar to Venmo should offer an intuitive, smooth, and visually appealing experience. When you customize and polish your UI/UX design, it also increases the cost of your app.

Whether it’s accessibility, user flow simplicity, or responsiveness across different screen sizes, these features contribute directly to the design workload. When you invest in premium design, you increase initial costs, which in turn boosts users’ engagement and satisfaction.

Be it frameworks, programming languages, backend infrastructure, or databases, tech stack selection has a higher impact on cost and development efficiency. Let’s understand important tech stacks you can consider to implement:

In addition to the above, you also need to integrate cutting-edge features into your app, including push notification services, secure payment gateways, analytics tools, and more. These have a higher influence on the overall development expenditure.

When you develop an app like Venmo, you need to integrate many third-party APIs to enable key functionalities. These mainly include identity verification, bank account linking, currency conversion, payment processing, and more.

Though APIs catalyze development, their integration often comes with licensing fees or additional subscriptions. You can harness the benefits of top APIs such as Stripe, Plaid, PayPal, Twilio, and more. These are indeed good for messaging.

You may be aware that an app like Venmo has to handle sensitive information, such as personal and financial details. So, it must follow necessary regulatory and security standards, which are indeed non-negotiable.

To protect sensitive data, implement security measures such as tokenization, two-factor authentication (2FA), end-to-end encryption, secure data storage, and more. These indeed boost development efforts as well.

Besides this, compliance with GDPR, PCI-DSS, KYC/AML, and more requires extensive additional documentation, audits, ongoing monitoring, and more.

Location of your development partner and their skill level also have a major impact on the development cost of your app.

We can take an example: developers from Western Europe and North America often charge more than those from Eastern Europe, India, and other Southeast Asian countries. These countries are ideal destinations for hiring highly skilled, experienced developers at a lower cost.

High-quality testing is quite important when developing an app similar to Venmo. Ensure your app undergoes rigorous testing to assess its security, performance, and functionality.

It’s advisable to perform a variety of tests, like integration testing, unit testing, security testing, load testing, and more. And each testing maximizes the total cost.

Apart from testing, you also need to budget for post-launch maintenance for your app. It includes many important features such as feature upgrades, bug fixing, regular security updates, and more. These also maximize your expenses.

While developing a Venmo-like app, you need to plan carefully for the features you need to integrate. The main reason is that features play a vital role in making your app engaging and, by extension, successful. Let’s explore some of the important features you need to integrate into your app.

To succeed, your app should offer a smooth onboarding process, which is especially important for a payment app. It should allow users to register for your app quickly via phone number, email, social media accounts, and more.

Secure authentication methods are essential to ensure safety and convenient access. Always keep in mind that a perfectly designed registration flow improves both reliability and retention.

Make sure your app offers multiple payment methods, including digital wallets, bank accounts, and debit or credit cards. These are essential to let users make payments through your app hassle-free and securely.

It’s important to integrate your app with third-party APIs such as Yodlee, Plaid, and others to provide fast, secure connections. This feature is quite essential for users to withdraw money, add funds, make payments, etc., without putting any effort.

Your app should let users request or send money hassle-free. It’s highly important to add features such as QR code payments, split bills, scheduled transfers, and more.

These features are pivotal to improving convenience. Real transaction tracking and quick fund settlement are pivotal to improving the platform’s reliability and usability.

With a detailed transaction history, your app lets users keep an eye on their every transaction and receipt. It should also display many important details, such as amounts, dates, recipient details, and more, in a clear, categorized format.

Make sure your app includes features like push notifications for pending requests, completed payments, failed transactions, and more. These improve transparency while letting users be informed every time.

Apps like Venmo are also better known for their social integration capabilities. So, while developing a payment app, you need to integrate features like emojis, in-app chat, payment captions, etc.

These transform transactions into a highly interactive experience. A social feed lets users visualize, like, comment, etc., on payments. It boosts engagement and interaction. It also allows users to access their most frequently used apps.

Security is highly important for any financial app. To make your app secure, you need to integrate features such as multi-factor authentication, AI-based fraud detection, real-time risk monitoring, and more. These are necessary to ensure transactions are safe from fraud or unauthorized access.

It is important to incorporate a robust admin panel into your app, which is essential for efficient transactions, user management, dispute resolution, and more.

Be it transaction monitoring, real-time analytics, report generation, or user verification, these tools are useful for admins to maintain effective operational control. These backend systems are necessary for a hassle-free operation, smooth user experience, and security compliance.

Our developers are always ready to build a custom fintech app by leveraging the next-generation technologies. We endeavor to deliver you a powerful digital solution.

Developing an app like Venmo involves multiple steps. Every step serves its core purpose to offer a smooth performance, user engagement, powerful security, and more. Let’s get the important details of each step:

It’s highly important to conduct thorough market research before you enter the development process. It gives you a detailed understanding of users’ likes/dislikes, competitors’ offerings, financial trends, and more.

During your research work, you need to gather details about many other leading apps, apart from Venmo. Doing this lets you identify gaps in design, features, functionality, etc.

In this phase, you need to make a list of all those features you wish to integrate into your app. If you plan to launch an MVP, you need to decide which features to include. These include essential features such as payment transfers, notifications, and transaction history.

On the other hand, for a full-fledged app, you can consider implementing features such as business payments, in-app chat, loyalty rewards, and more.

Selecting the right tech stack is essential for determining your app’s performance, scalability, security, etc. Whether front-end or back-end, you need to select the right tech stack before coding. We already mentioned the right tech stacks for these developments.

Apart from this, you also need to select the top cloud services, such as Azure, AWS, and Google Cloud. These are essential for offering higher scalability. Apart from this, for databases, you can choose MongoDB, PostgreSQL, and others for highly efficient data handling.

Now, it’s time to design your app. It’s advisable to focus on crafting an intuitive user journey, right from user registration to transaction confirmation. Make sure your app includes minimal navigation steps, clean layouts, clear CTAs, and more.

To make it more meaningful, you need to implement animations, micro-interactions, and personalization. These improve both user engagement and satisfaction.

This step involves backend development that can handle user management, transactions, communication, and more. These are possible by integrating many external services.

You need to integrate various third-party APIs for various purposes, such as payment gateways, bank connectivity, identity verification, messaging, and more.

Make sure you embed security at every stage of your app development. You need to add cutting-edge security features to make your app more secure, including fraud detection systems, multi-factor authentication, end-to-end encryption, and more.

Apart from this, you also need to make your app comply with GDPR, PCI-DSS, KYC/AML, etc.

You need to proceed with a clear strategy for your app testing. You need to perform all necessary testing to ensure your app is free of bugs and vulnerabilities. Once you are satisfied with everything, launch your app, then analyze performance and gather user feedback to revamp it.

As a digital payment application development company, we make your Venmo-like app development journey successful by delivering a full-fledged, high-performing app. Our developers have expertise in combining security, innovation, and scalability to deliver a world-class app. We have unmatched expertise for fintech app development.

Our app development team specializes in creating peer-to-peer payment solutions with robust encryption, real-time transfers, intuitive UI/UX, and more. We cater to businesses by developing a user-friendly, secure digital payment solution tailored to modern financial requirements.

So, you understand how to develop an application like Venmo, right? Before you proceed with your app development, it’s highly important to understand the project requirements, purpose, goals, objectives, target audience, market scenarios, and more.

Once you gather all these details, you can proceed to develop a high-performing app. For development, you can partner with a leading mobile app development company like us to get expert guidance, end-to-end development support, advanced technology integration, and more.

01

02

03

04

Submitting the form below will ensure a prompt response from us.